Martin Lewis has recently issued a critical debit card warning that every UK bank customer should pay attention to. With millions using NatWest, Barclays, Lloyds, and Nationwide cards, his guidance highlights potential hidden risks that many people overlook. The warning emphasises that relying solely on debit cards can expose users to fees, overspending, and even fraud, making it essential to stay informed.

The martin lewis debit card warning comes at a time when many people assume their debit cards are entirely safe. While convenient for everyday purchases, debit cards often lack the protective measures offered by credit cards. Understanding the expert advice provided in this warning can help users make smarter financial choices, protect their money, and avoid unexpected charges.

Why Martin Lewis is Warning Debit Card Users

Martin Lewis issued this warning after observing growing risks for debit card users across the UK. Many consumers underestimate the hidden charges that banks may impose, such as foreign transaction fees, non-sterling exchange costs, and delayed fraud compensation. The martin lewis debit card warning serves to highlight these issues and alert users to potential pitfalls before they occur.

Additionally, martin lewis debit card warning stresses that debit cards offer limited protection against fraud compared to credit cards. If unauthorised transactions occur, recovering funds can be challenging and time-consuming. Users of NatWest, Barclays, and Lloyds are particularly encouraged to remain vigilant and follow the practical guidance offered to minimise exposure to financial risks.

Key Risks Associated with Using Debit Cards

The first risk highlighted in martin lewis debit card warning is the potential for hidden fees. Many UK customers are unaware that banks can charge for foreign transactions, online purchases, or even certain types of domestic spending. These costs can quietly accumulate, leaving users with higher-than-expected bills. Regularly checking statements is an essential step to avoid such surprises.

Another major concern raised by martin lewis debit card warning is the threat of fraud. Debit cards are directly linked to a bank account, meaning any unauthorised use can immediately affect available funds. Scammers increasingly target debit card users because once the money is withdrawn, it can take time to recover. Staying alert and taking proactive security measures is essential for all UK consumers.

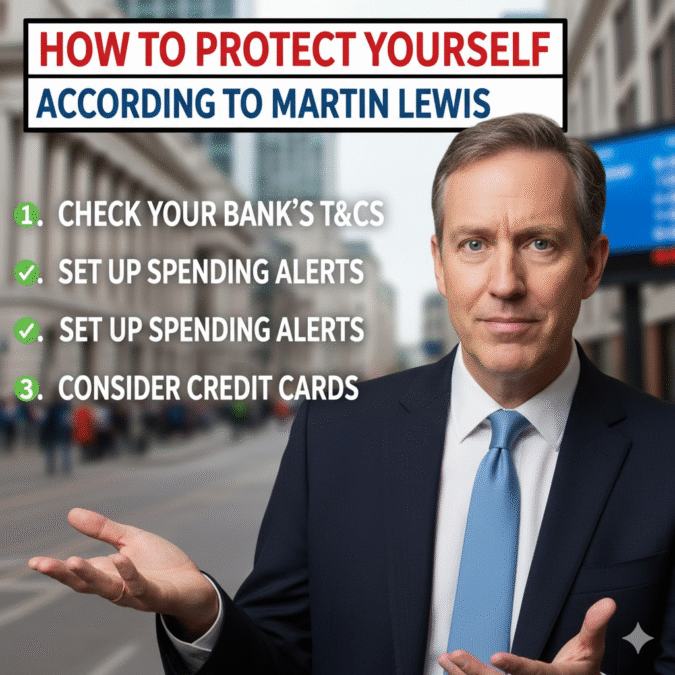

How to Protect Yourself According to Martin Lewis

Following the martin lewis debit card warning, there are practical steps users can take to protect themselves. Setting up notifications for every transaction ensures that unusual spending is detected quickly. Regularly reviewing account statements also helps identify hidden charges and reduces the risk of unnoticed fraud. Monitoring daily spending allows users to manage finances effectively and stay in control.

Martin Lewis also advises considering credit cards for certain transactions. Credit cards often offer better consumer protection, including chargeback rights for disputed purchases. For UK banks such as NatWest, Barclays, and Lloyds, enabling security features like two-factor authentication, spending limits, and card freezes can further enhance safety. This advice is central to the martin lewis debit card warning.

Debit Cards vs Credit Cards: Which is Safer?

Martin Lewis debit card warning points out that while debit cards are convenient, they lack the protections inherent to credit cards. Debit cards withdraw funds immediately from the account, leaving little recourse if fraud occurs. Credit cards, on the other hand, allow users to dispute transactions and often provide insurance for online purchases or travel-related spending, making them safer in certain circumstances.

The warning emphasises the importance of using both debit and credit cards wisely. For everyday purchases and cash withdrawals, debit cards remain practical. However, for large online transactions or international spending, credit cards can offer added security and peace of mind. Following this guidance ensures a balanced, safe approach to everyday banking, as highlighted in the martin lewis debit card warning.

What UK Customers Should Do Now

UK customers should take immediate steps in response to martin lewis debit card warning. Checking all recent transactions, identifying unexpected fees, and setting up alerts are crucial first steps. Contacting the bank promptly if any suspicious activity is found helps prevent financial loss and ensures rapid action in case of fraud.

Remaining informed is another key recommendation from martin lewis debit card warning. Following reliable news sources and financial experts helps users adapt to changes in banking policies, fees, and security measures. Proactive measures, combined with careful monitoring, offer the best defence against potential risks associated with debit cards.

Conclusion

Martin Lewis debit card warning serves as an essential reminder that UK bank users cannot take debit cards for granted. Hidden fees, potential fraud, and overspending are real concerns that can be mitigated through careful monitoring and informed decision-making. By following Martin Lewis’ advice, users of NatWest, Barclays, Lloyds, and Nationwide can protect their finances and use their cards safely.

FAQs

What is the martin lewis debit card warning about?

It warns users of hidden fees, risks of overspending, and limited protection against fraud compared to credit cards.

Which UK banks are affected by the warning?

NatWest, Barclays, Lloyds, and Nationwide are specifically mentioned in martin lewis debit card warning.

Are debit cards less safe than credit cards?

Yes, debit cards provide less protection against fraud and disputes than credit cards.

How can I protect my debit card?

Set up transaction alerts, review statements regularly, enable security features, and consider credit cards for high-risk purchases.

Should I switch to a credit card instead of using a debit card?

For large or online transactions, credit cards offer added protection, as advised in martin lewis debit card warning.